COVID-19 Shutdowns: A Case Study

Background

The client is a $3 billion, publicly traded global manufacturer which traditionally experiences high employee churn and has relied on a Supplemental Unemployment Benefit (SUB) Plan to pay separation benefits for over ten years.

A Supplemental Unemployment Benefits Plan (SUB Plan) an IRS-approved, tax-advantaged and highly efficient structure which serves as an alternative to traditional severance. A SUB Plan maintains weekly income for permanently or temporarily displaced employees while generating considerable cost savings for the employer.

Under a SUB Plan, the weekly employer-paid separation benefit is offset by the amount of State Unemployment the employee may receive. Displaced employees maintain their pre-displacement wage, while employers save 30-50% when compared to traditional severance.

Problem

In 2020, the economic crisis caused by the COVID-19 pandemic forced a widespread shutdown of operations. It became necessary to implement an immediate reduction in force.

Solution

Due to the client’s prior strategic workforce planning and incorporation of a SUB Plan, they were able to seamlessly integrate the pandemic-related layoffs without delay, allowing for maximum benefits to both the business and its employees.

Transition Services was responsible for processing the benefits of the furloughed employees and acted as the main point of contact for these individuals from the time they were informed of being laid off to the expiration of their benefit period. This included:

- Supporting participants with claiming state Unemployment Insurance (UI)

- Tracking participants’ unemployment status and eligibility for benefits

- Communicating directly with HR and payroll to ensure seamless processing

Short-term Results

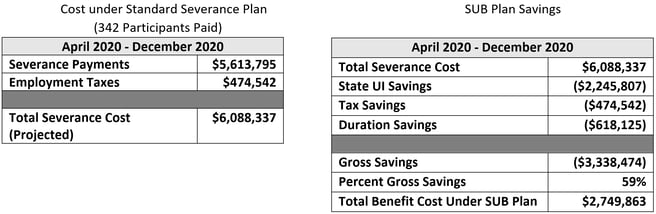

Utilizing a SUB Plan during the pandemic related shutdowns from April 2020 to December 2020 resulted in $3.3 million (59%) in savings compared to traditional severance, while maintaining the income of the released employees during their benefit periods.

Long-term Results

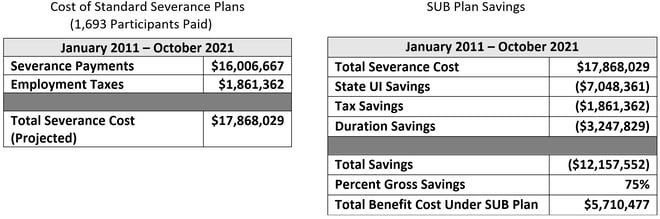

While the 2020 reduction in force resulted in an impressive level of immediate savings, it is equally notable to see the savings over the long term through regular business cycle fluctuations. Over a ten-year period, the client saved $12 million (75%) in savings compared to traditional severance, while maintaining the income of the released employees during their benefit periods.

SUB Plans are a highly efficient and employee-friendly structure for workforce management, useful for unforeseen downsizing events as well as regular business operations. Incorporating a SUB Plan into a company business model allows for a smooth and simple administration of employee payments with a reduction in force, either temporary or permanent. Employees benefit from a stable income stream, which serves as a bridge to the next employment opportunity, and employers benefit from the efficient SUB Plan structure. The pandemic has taught us that these are times of uncertainty, therefore workforce contingency planning is crucial for forward-thinking companies with plans to thrive over the long term. SUB Plans are a highly practical tool which allows employers to maintain a people-focused approach while attending to the bottom line.